10 Simple Techniques For Feie Calculator

The 5-Minute Rule for Feie Calculator

Table of ContentsThe Best Guide To Feie CalculatorNot known Details About Feie Calculator Rumored Buzz on Feie CalculatorThe Buzz on Feie CalculatorAn Unbiased View of Feie Calculator

He marketed his U.S. home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his partner to aid accomplish the Bona Fide Residency Examination. Neil directs out that getting home abroad can be challenging without initial experiencing the area."It's something that people require to be really thorough about," he states, and suggests deportees to be careful of usual blunders, such as overstaying in the United state

Neil is careful to stress to Stress and anxiety tax united state tax obligation "I'm not conducting any performing any type of Service. The U.S. is one of the couple of countries that taxes its residents regardless of where they live, indicating that even if a deportee has no revenue from U.S.

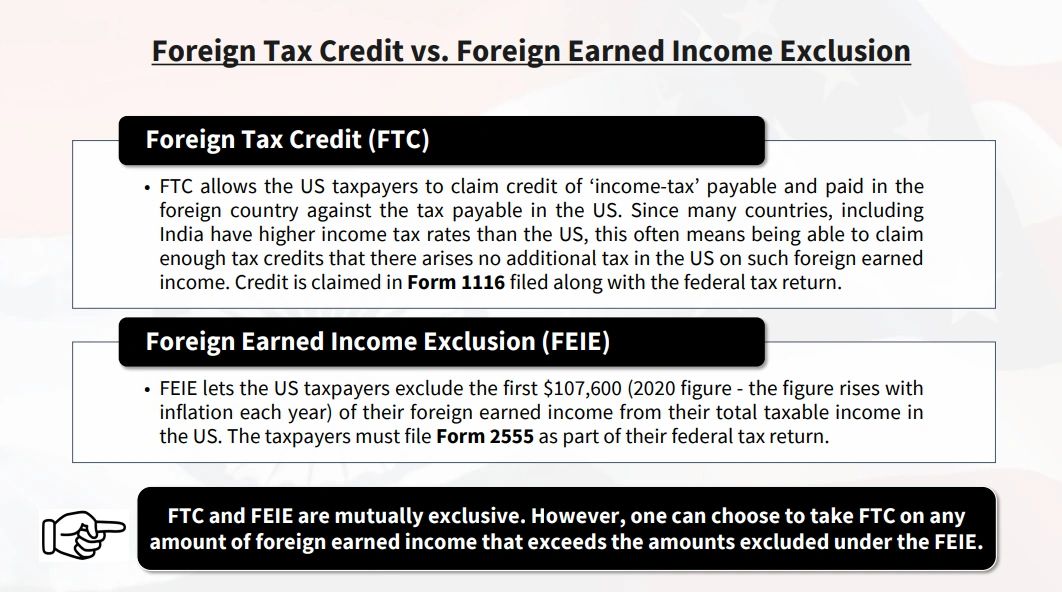

tax return. "The Foreign Tax Credit rating permits individuals functioning in high-tax nations like the UK to counter their United state tax obligation obligation by the quantity they have actually currently paid in tax obligations abroad," says Lewis.

The Main Principles Of Feie Calculator

Below are several of one of the most frequently asked concerns concerning the FEIE and various other exemptions The Foreign Earned Earnings Exemption (FEIE) permits united state taxpayers to exclude as much as $130,000 of foreign-earned income from federal earnings tax, lowering their U.S. tax liability. To qualify for FEIE, you must satisfy either the Physical Existence Test (330 days abroad) or the Authentic Home Examination (confirm your primary residence in a foreign nation for an entire tax obligation year).

The Physical Presence Test likewise calls for United state taxpayers to have both an international revenue and an international tax home.

What Does Feie Calculator Do?

An earnings tax obligation treaty why not look here in between the U.S. and another nation can help stop dual taxation. While the Foreign Earned Earnings Exclusion decreases taxable earnings, a treaty might give added advantages for eligible taxpayers abroad. FBAR (Foreign Bank Account Report) is a called for declare united state citizens with over $10,000 in foreign economic accounts.

Eligibility for FEIE depends on conference specific residency or physical presence examinations. is a tax advisor on the Harness platform and the creator of Chessis Tax. He is a participant of the National Association of Enrolled Representatives, the Texas Society of Enrolled Representatives, and the Texas Culture of CPAs. He brings over a years of experience helping Big 4 firms, encouraging migrants and high-net-worth people.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax expert on the Harness platform and the creator of The Tax Dude. He has over thirty years of experience and now concentrates on CFO solutions, equity payment, copyright taxes, marijuana taxes and separation related tax/financial planning matters. He is a deportee based in Mexico - https://sketchfab.com/feiecalcu.

The foreign made income exemptions, occasionally referred to as the Sec. 911 exclusions, leave out tax obligation on salaries made from working abroad. The exemptions comprise 2 components - an earnings exclusion and a housing exemption. The complying with FAQs go over the advantage of the exclusions consisting of when both spouses are deportees in a general fashion.

A Biased View of Feie Calculator

The tax advantage leaves out the income from tax obligation at bottom tax rates. Formerly, the exclusions "came off the top" lowering earnings subject to tax obligation at the top tax obligation prices.

These exclusions do not exempt the wages from United States tax yet merely offer a tax decrease. Note that a bachelor working abroad for all of 2025 who earned concerning $145,000 with no various other earnings will certainly have taxable revenue lowered to no - efficiently the very same solution as being "free of tax." The exclusions are calculated each day.